Investment Philosophy

WEALTH THROUGH WISDOM

The investment philosophy behind the Helios India Rising PMS has developed over the past 25+ years. We have one of the most experienced teams in the Indian Fund Management Industry with over 100 years of direct India investing experience- covering the same market for so long gives us a significant advantage. We know the history and strengths & weaknesses of most corporate managers/owners/sell side analysts/strategists and have a deeper understanding of the psychology that drives Indian markets.

With multiple financial and business channels, quarterly results and conference calls, number of conferences and management road shows, social media and blogs and extensive coverage from sell side the real difference between investors is no longer information but knowledge. Using a robust and consistent framework to assimilate this information to form meaningful insights is more important than simply chasing raw information.

“…the real difference between investors is

no longer information but knowledge.”

It is here that the collective experience of the investment professionals in our team counts the most for as we all know “What you see depends on what you have seen”. And we have seen a lot.

We believe that strong and consistent portfolio returns come from both good stock selection AND good portfolio construction. Building a robust portfolio requires answering four fundamental questions:

![]() Which stocks should we buy?

Which stocks should we buy?

Strong theme/size of opportunity

We are bottom-up investors who believe that stock picking works best when aided by the secular tailwind of a strong theme or positive “big picture”. Being long term investors requires us to have a good understanding of the theme (potential size of opportunity, barriers to entry, competitive intensity etc.) as it allows us to hold onto a stock even if it becomes temporarily expensive due to strong returns. Over decades of investing we have come to strongly believe that while buying robust businesses yields fair returns, adding the benefit of a strong secular tailwind leads to multiyear outperformance.

Our preferred investment themes are characterized by “Non-zero-sum competition”.

Theme 1: Compete with govt owned companies

Theme 2: Demographic/lifestyle changes (primarily urban under-penetration)

Theme 3: Factor Cost Advantage (Information Technology/Pharmaceuticals/Speciality Chemicals etc.)

We may own stocks that do not neatly fit our favoured themes if they offer exceptional value, trigger or some other fundamental reasons for owning.

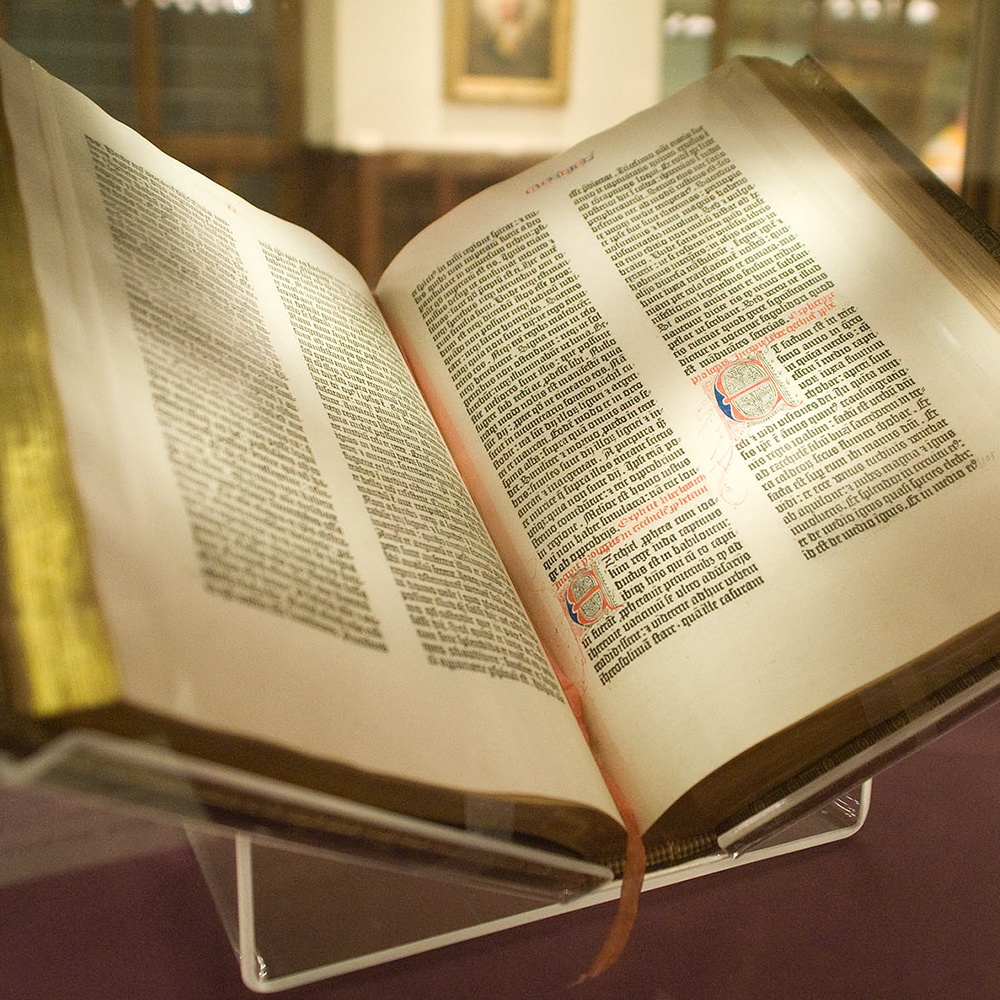

“ ‘via negativa’ (acting by removing) is more powerful

and less error-prone than

‘via positiva’ (acting by addition)”

Nassim Nicholas Taleb: “Skin in the Game”

Start with “Why Not to Buy”

By starting our analysis with “why not to buy” a particular stock, we ensure that our potential “buy” pool is a carefully chosen list of attractive companies – we simply insist on contemplating amongst robust and sustainable businesses.

We may reject stocks on (even) one or more sub factors of the following factors: Theme/ Industry dynamics, potential for disruption, management history, corporate strengths and strategy, corporate governance, financial performance, valuations and medium-term triggers.

Stocks may be rejected permanently (“we will never buy”) or temporarily (“we will currently not buy”). From the “cannot easily reject on any factor” list, we do further bottom up analysis to arrive at the “to OWN list”.

Easier to know what is bad than to know what is good

It is easier to “reject stocks with conviction” than to “own stocks with conviction” for it is easier to know what is bad than to know what is good. A single negative factor may be enough to know that an investment may be bad whereas even multiple positive factors may not be enough to get conviction that the investment may be good.

We believe that there is enormous value in differentiating between good and bad stocks but less so in differentiating between two good stocks (particularly if they are in different sectors and therefore are driven by different dynamics and cannot be compared directly- though we still try).

To overly differentiate between good and good (particularly in different attractive sectors) is many times merely a theoretical exercise and subject to too much randomness and forced selection.

![]() What is our time horizon?

What is our time horizon?

Our analysis of the past 25 years data shows that about 1/3rd of the stock perform materially better than the overall market over every period. This is otherwise also logical for if the market average return is an average of all the stock returns (weighted by size of company, no doubt) in general half the companies should do better than average and half should do worse than average.

Even though approximately 1/3rd of companies do much better than the overall market over all periods, their extent of out-performance declines over longer time horizons. This is because although many companies may perform significantly than the overall market over some periods, reversion to mean does not easily allow the elevated level of performance over longer periods.

Longer term winners surprise even themselves, their managements and their investors with their growth/success and cannot be generally identified well in advance with high degree of confidence. If this were not the case, Steve Jobs would have had a higher proportion of his wealth in Apple Inc than in Walt Disney (which he got for selling Pixar to Walt Disney) and Bill Gates would not have sold down his shares in Microsoft to the extent that he did to be able to “diversify”.

We therefore believe that the sweet spot for initial investing horizon is 1 to 3 years for one can more easily analyse industry trends/potential for disruption/current company and management strengths/external environment/market preferences etc. while also having the possibility of catching stocks in phases where they significantly out-perform the market. If a company continues to do well, we can simply extend our holding period on the basis of another 1 to 3 year analysis and so on (as we have done many times in our career).

Long term does not mean “Buy & Forget”

Even though we end up being long term investors on the long side in many cases, we are not willing to simply assume that companies will continue winning at the same rate or in the same manner many years down the line. We therefore start by attempting to identify 1 to 3 year winners and then take it from there.

We also believe that the long term is a series of short terms. This means that even though we are willing to (and in practice do) hold stocks for long periods, we evaluate them continuously to confirm that our original hypothesis to buy the stock is intact.

Over our long investing history, we have seen that holding a well performing stock for a long period is not the same as holding a stock where the market really tests your conviction as the stock goes down a lot or trends sideways for several quarters/years. We have had many such experiences in our career and in most cases our conviction has paid off.

![]() How many stocks should we own at a time?

How many stocks should we own at a time?

A robust portfolio should have 2 kinds of stocks:

– Stocks that offer “high confidence in reasonable returns”

This group has higher quality, consistently performing companies with clear strengths, significant size of opportunity and high visibility of earnings. We do not expect these companies to get (further) re-rated but are happy with their expected growth for the next few years. We sell these stocks if valuations become too high or if there are some fundamental changes which make us reconsider our case for the company.

– Stocks that offer “reasonable confidence in high returns”

This group comprises of companies where we expect higher returns from a combination of earlier discovery (or re-discovery) of stock and re-rating of company if it delivers on our expectations.

Build a stock relay team (portfolio) that works across time

We believe that a good portfolio does not mean that all stocks must perform well at all times. A well-constructed portfolio is like a stock relay team where some stocks are currently performing, some stocks having done well are consolidating and some other stocks are getting ready to (hopefully) do well in the future. This philosophy allows us to nurture long term but out of favour ideas while the overall team (portfolio) is doing well.

No one knows anything about anything beyond a point

Investing is largely about predicting the future and the best one can do is to improve one’s odds of being right. Since future is uncertain even in the best of times, we need to approach investing (and indeed life) with humility.

We reject a concentrated portfolio strategy (owning 10-15 stocks) for a number of reasons:

- By the time one finds conviction to have a very high allocation (that a concentrated portfolio would imply), one would have missed a larger part of the appreciation in many stocks. For most investors, consistent and strong performance of the company and stock is itself one source of conviction.

- We only hear of winners of this strategy as people who happen to mistakenly concentrate on the wrong stocks disappear from the industry. Therefore the perceived success of this strategy is much higher than the actual success due to “survivorship bias” where winners/survivors distort the actual returns from strategy.

- We know that a number of companies do really well each period. Placing smaller bets of 1.5% to 3% on a larger number of “well selected” stocks allows one to improve the odds of hitting it big without the accompanying downside if one or more bets go wrong.

Our learning (and track record) shows is that there is therefore no compromise in performance in owning a portfolio of 30-35 stocks with (initially) a 1 to 3 year view.

Knowing that many stocks do well each year (but not exactly knowing whose turn it is next), we are comfortable holding a basket of well selected stocks at any point of time. Our bet is that if we choose these stocks from attractive themes/sectors, reject what we don’t like and then do further work to arrive at BUY list we have a fair shot at having many of our stocks in the large list of stocks that anyway do well each year.

7-10 stocks will be new each year and then held for 1-3 years while another 10-15 stocks will be held for very long time. The stocks that are held for long term are not identified in advance but if the company and the stock is doing well there is no reason to not hold it for a longer time.

Our portfolio is therefore always fresh and this mix has given us the consistent out performance we have had across years, cycles and phases of the market without taking too much of the idiosyncratic risk that comes with more concentrated positions.

![]() When to sell?

When to sell?

Continuous and close monitoring of positions

As previously indicated, we believe that the long term is made up of a series of short terms and that we do not simply “buy and forget” believing that a particular stock must be held forever. Although we hold most stocks for multi year periods, we continuously evaluate and monitor the companies to confirm whether our original hypothesis on the stock is intact. We are not afraid to acknowledge unfavourable developments or departures from our original thesis and may accordingly exit/ trim the position ahead of our originally intended holding horizon.

Reasons for trimming/selling stocks may be (absolute or relative) fundamental, stretched valuations or risk control

- If there is deterioration in company fundamentals or an unexpected negative development, stock will normally be sold to zero

- If stock returns significantly outperform underlying earnings growth over an extended period, stock weight may be trimmed or sold completely

- High valuations may be acceptable up to a point for high-quality companies but we don’t believe in “Buy/Hold at any valuations”

- Stock may be sold/reduced to make room in the portfolio for another stock or for risk control on both stock and sector exposure

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Charlie Munger: “Seeking Wisdom: From Darwin to Munger”