Portfolio Construction

Astute portfolio construction to enhance the Edge gained from Research

We believe our fundamental research and our Elimination Investing EITM approach gives us an edge over the market. We aim to convert that into a larger and more sustained advantage through astute portfolio construction. This entails the answering the following questions:

- Do we have the right level of diversification, and avoidance of over-concentration in positions, pockets and clusters of risks?

- Do we have an all-weather portfolio that we have a high confidence will deliver excess-returns over the cycle and across different market environments?

- Does the portfolio have the right distribution of names across different stages of growth and delivery of returns i.e. some that are delivering well and some that are beginning to get to the stage where these will be delivering well?

- Are we focused on pro-actively minimizing any laziness in the portfolio i.e. are we dispassionately rotating out of names where return expectations are now lower?

Constructing a Bar-Bell Portfolio

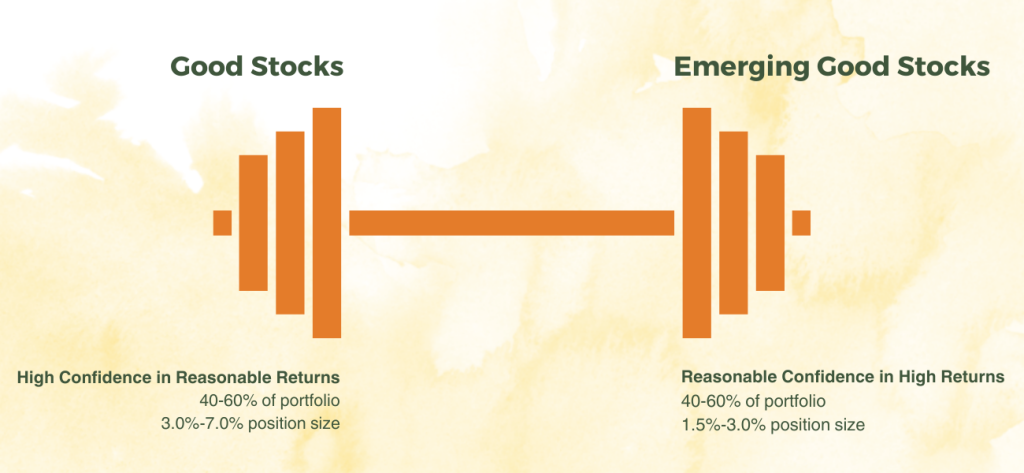

The portfolio is constructed using a bar-bell approach with two kinds of stocks:

"Good Stocks" or stocks that offer "High Confidence in Reasonable Returns"

- We strive for 40-60% of the portfolio in such companies with approx. 3% to 7% per position.

- Confidence in these stocks is high due to proven track record and good history and quality of management. Market is also aware of these factors, and so our focus is on future growth and the valuations we are willing to pay for these "already discovered" stocks.

- These are higher quality, consistently performing companies with clear strengths (moat), size of opportunity and high visibility in earnings.

- We do not expect these companies to get further re-rated but are happy with their expected growth for the next few years.

- We sell these stocks if valuations become too high or if there are some fundamental changes which make us reconsider the investment case.

- These companies comprise the lower turnover part of the long book.

- Differentiation for these stocks versus peers comes mainly from timing of buy/sell and sizing.

"Emerging Good Stocks" or stocks that offer "Reasonable Confidence in High Returns"

- We normally expect to have between 40-60% of the portfolio in such companies, with average initial weight of 1.5% to 3% per name.

- We expect higher returns from these companies from a combination of earlier discovery (or re-discovery) and re-rating if the company delivers on its potential.

- Some of these stocks are mid-caps and small caps, but they could also be large caps where we see trigger for sustained recovery or re-discovery by market.

- These stocks have potential to offer significant alpha when compared to "Good Stocks" that would typically offer smaller but more consistent alpha i.e. with higher certainty of alpha.

- These stocks comprise the more active part of the long book.

- Differentiation vs. peers for these stocks is via early discovery or timing of buy/sell and sizing.

We believe one should never label a company as “high confidence in high return.” This leads to costly errors.

Since many stocks do well each year and we cannot be fully certain whose turn it would be next, we believe we need to hold an adequately populated basket of well selected stocks at all points in time. As we choose these stocks from attractive themes/sectors, eliminate stocks that do not pass our 8 Factor Elimination Investing process, and do the deep dive research work to arrive at a Core Buy List (that cannot be rejected on any factor) from which we select stocks, we believe we have a fair shot at outperforming consistently.

Sell discipline and avoiding a lazy portfolio

We expect to have 7-10 new stocks each year that are then held for 1-3 years, while another 10-15 stocks are likely to be held for very long time. The stocks that will be held for the long term are not identified in advance as such, but if a company and its stock continue to do well and pass our Elimination Investing framework and research process, it may be held for a long period of time.

While our research process is deeply fundamental, and we aim to form a view and invest in stocks over a series of 1–3-year time horizons, we also pay attention to all news-flow, corporate developments and quarterly earnings announcements. We aim to be dispassionate, research oriented, and knowledge based in our holding of companies and in the sell discipline. Should the thesis change, or there not remain enough upside in a stock, or there be better investment opportunities elsewhere, we would look to trim or exit such positions.

Constructing an alpha generating short book

For Helios’ Long-Short strategies, the short book almost exclusively comprises stock shorts with index shorts typically used only at the margin or for tactical adjustments. Over the years, the short book has generated consistent alpha. In fact, in certain years it has generated positive absolute returns despite the benchmark indices being up as well. We believe this is in large part to our Elimination Investing (EITM) framework, which by its very nature is geared toward identifying stocks with problematic issues and negative triggers i.e. stocks that rate “Bad” on any of the 8 factors. Such stocks are eliminated in the research process in order to arrive at the Core Buy List of about 100 stocks from which the long portfolio is constructed. These eliminated stocks then become candidates for shorting, subject to other criteria being met. The actual timing of initiating short positions will follow our analysis and conclusions that fundamentals are deteriorating, or on negative events, coupled with high valuations rather than on the basis of high valuations alone.

The Helios Long-Short portfolio typically has 15-30 short positions, sized at 1.0% to 2.5% of NAV weight per position. Shorts are alpha driven and sector agnostic, and are usually not pair trades. The short book is highly diversified, with the focus being on robust fundamental analysis ensuring a high percentage of alpha wins. The short book specifically avoids undertaking larger sized positions since these can cause significant and permanent loss of capital should a stock perform contrary to the core thesis, for example in meme stock type situations. The short book is constantly triangulated for fundamental views, technical views and event risks on positions, and are generally undertaken with a 3 month to 12 month view.